By Nancy Phillips and Carrie Phillips Forbes, NHADA Bronze Partner, Nancy Phillips Associates, Inc.

THREE DECADES OF DEALERSHIP VALUES IN GREATER NEW ENGLAND

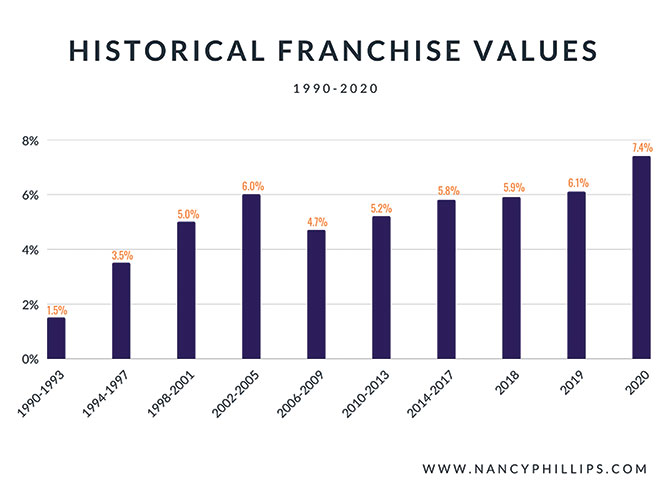

Information in the chart above taken from Dealership transactions completed by Nancy Phillips Associates (NPA) and affiliated Sellers. Data is based on original values prior to any reallocation of purchase price.

Transactions may include Pending Transactions approved by Franchisor.

Nancy Phillips Associates has been selling auto dealerships throughout New England and New York State for 30 years. Documenting and studying dealership transactions has proven to be a reliable way to anticipate and project future dealership values. Every month we receive numerous calls from dealers asking what the current multiples are for their franchise. The flaw with this method is that a dealership losing money may in fact be worth the same as a profitable one.

We have found that value is often more accurately interpreted when Business Value (Goodwill) is defined as a percentage of total dealership revenues. This method also requires careful analysis of dealership financial statements, recasting of true net profit and concise adjustments for rebranding requirements in order to insure that the dealership’s unique potential is clearly understood. The three key elements to dealership value are Franchise, Market Area and Facility. Profitability may be an enhancement, however loss or under average profitability should not be a deterrent.

Few Buyers Radically Overpay

While there have been exceptional increases in the amount of Business Value paid for certain franchises, overall fluctuations have been moderate. They are neither as low as you might have expected during bad years, nor do they skyrocket in better years. That’s because buyers in difficult markets pay based on better futures and those buying at the top of a market do so with an eye toward the next downturn. There are very few buyers, regardless of size, who will substantially overpay without a quantifiable return.

The Market Today

Yes, the market is strong today, but nothing lasts forever and the current surge may be short lived. Despite the ongoing pandemic, dealers did very well in the second half of 2020. Profits were up, expenses were down, and more dealerships than normal changed hands. Yet, you will see from the chart 1 depicting historical franchise values that the increase from 2018 to 2019 was moderate and was higher than expected in 2020.

We believe this is tied to the trend of bigger buyers with more available funds, and a serious concern for the volatility of their non-automotive investments. Quite simply, the current state of our economy and the world at large contributed to the thinking that investing in auto dealerships is safer than other investment opportunities during this volatile time.

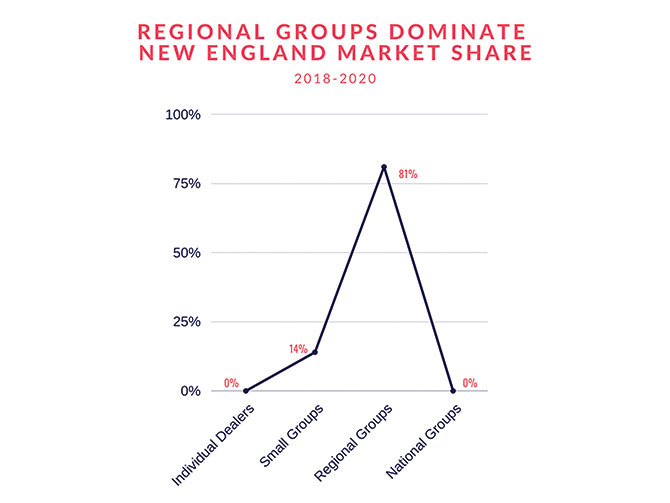

Chart 2

2021 Predictions

We believe that 2021 will see many dealers addressing concerns for the future of their dealerships. Continued economic downturn, increasingly conservative lending perimeters and increased taxation could mean that the opportunity to sell for a strong number may not survive into 2022.

Greater New England 2020

Dealerships in Maine, New Hampshire, Vermont, Massachusetts, Connecticut, Rhode Island and New York State sold for prices somewhat higher than in 2019. While our firm experienced delays in closings scheduled for March, April and May, not one dealership sale was cancelled or re-negotiated. Dealership evaluations remained as strong as in 2019 and for some franchises have increased.

Dealership sales and values are rising in

secondary markets

Due to the pandemic and concerns about changes in our demographics, there is one new and very interesting trend that has occurred throughout Greater New England and that is an increase in the desirability of secondary market area dealerships. The migration to small cities and communities incentivized by the pandemic and it’s ramifications in major metro areas has caused many strong buyers to take a look, for the first time, at a different type of market area. When they did, they found a lower cost of entry, more moderate real estate values, longer term employees, reduced expense structures, higher used vehicle sales and more loyal customers.

In fact, the number of secondary market area dealerships in Greater New England sold to regional dealership groups has never been higher. We believe this new wave of dealership acquirers that are willing to purchase in areas they would have previously ignored, bodes well for the value of secondary market area dealerships.

Upgraded facilities are viewed more favorably and sell for more

We believe that the incremental increase in dealership values over the last few years has a great deal to do with the investment in new buildings and expensive facility upgrades that dealers have recently made. Some dealers found these investments could not be absorbed by their operations and their dealerships became unprofitable or much less profitable as a result. This developed into a higher number of brand compliant facilities with desirable franchises being offered for sale. Fortunately, the transition in buyer type demonstrated in chart 2 meant that larger, stronger buyers willing to orchestrate a major turnaround of an underperforming dealership became the prime candidates for these dealerships. There is an enormous cost involved in acquiring a non-compliant dealership and the benefit of a new facility is a great incentive to today’s regional buyer. The time it takes for a well planned turnaround verses a major construction project can be analyzed and determined in advance so that a reliable and bankable decision can be made about the viability of the acquisition.

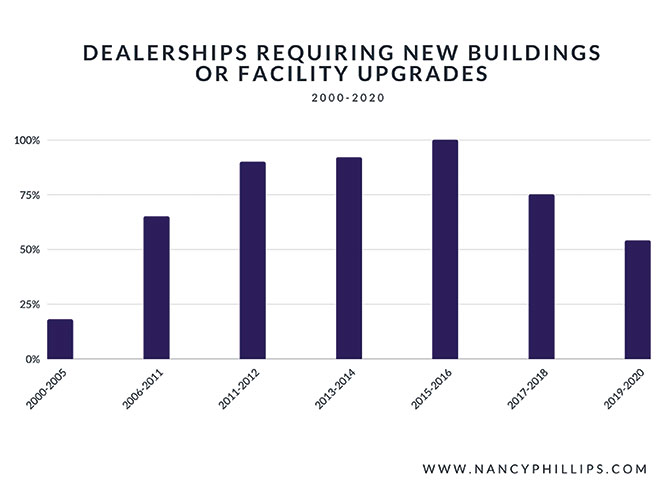

Trajectory of bricks and mortar in the industry

Only 20 years ago, less than 25% of dealerships sold by our company needed to perform new construction or significant renovation. This increased steadily until 2016 when 100% of the dealerships sold were required by their franchisors to upgrade in order to obtain approval. As more and more facilities build or upgrade to become compliant, additional dealerships become available for sale because their owners cannot find their way to profitability under their higher expense structure. See chart 3.

Chart 3

You should consider selling if:

- Your dealership is not profitable

- You are facing a significant facility upgrade

- You are not meeting your sales performance criteria

- Your floor plan lender does not want you

- You have serious health problems and no legacy plan

- You do not wish to go through another

economic downturn - Your contiguous market is being overtaken by larger dealer groups

You should consider buying if:

- An opportunity becomes available in your market area

- Your franchise is up for sale in a contiguous market

- You wish to keep an outside group out of your area

- You have multiple adult kids in your business

- You have good general managers who may leave you if you do not provide an equity position

This content is part of a larger article. Read more here: https://bit.ly/3o63Q9J