As part of the recently enacted state budget (House Bill 2), motor vehicle-related fees across New Hampshire have increased in multiple categories. These adjustments were included to help close statewide budget gaps and ensure that essential state services remain adequately funded.

While no business welcomes increased operating costs, it is important for dealers to understand where these changes have occurred, how they may affect day-to-day operations, and where to anticipate additional expenses when processing customer transactions.

The following breakdown summarizes the major changes across Dealer Fees, Registration Fees, License Fees, Boat Fees and Salvage Fees, along with context to help you communicate these adjustments internally and to customers if needed.

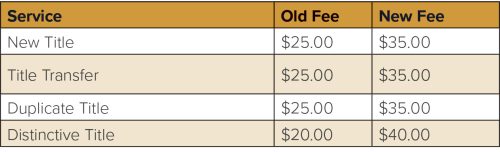

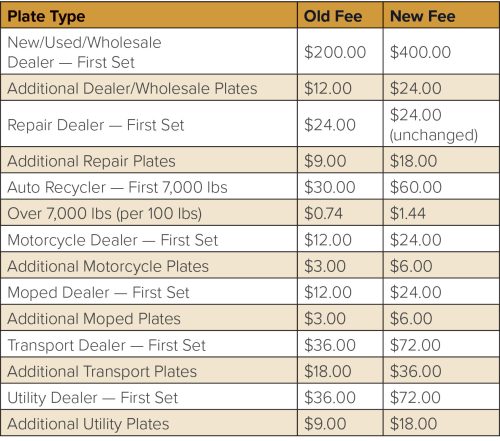

1. Dealer Fees

Title-Related Fees

Dealer Plates

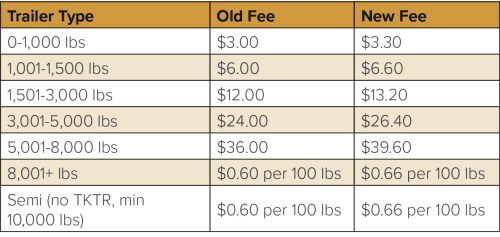

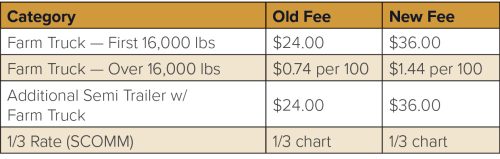

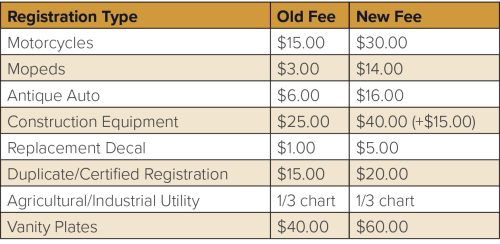

2. Registration Fees

Short-Term and Specialized Registrations

Passenger & Light Truck (Weight-Based)

Trailers

Farm and Commercial

Motorcycles and Miscellaneous

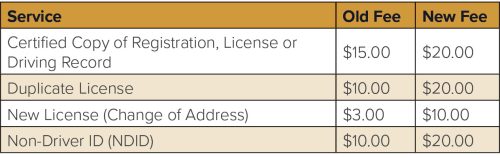

3. License Fees

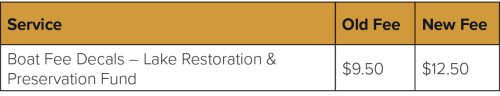

4. Boat Fees

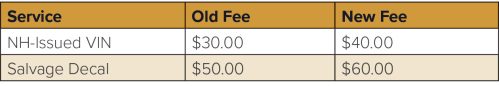

5. Salvage Fees

What These Increases Mean for Dealers

These fee changes will have practical effects on dealership operations, both internally and in customer-facing transactions:

- Overall operating costs will rise, particularly in areas where dealer plate and title fees have doubled or significantly increased.

- Customer communication will be important, as buyers may have questions about higher state-imposed fees during the purchase or registration process.

- Dealership processes may require updates, including revising fee charts in sales paperwork, updating software systems and ensuring staff are aware of the new amounts.

These changes reflect broad adjustments made in the state budget, and dealers should be prepared for their financial and workflow impacts as they take effect.

Looking Ahead

Dealers should ensure all staff are fully familiar with the new fee structure so that questions can be answered accurately at every stage of the sales and registration process. Clear internal communication, paired with updated paperwork, signage and digital tools, will help minimize confusion for both employees and customers.

Maintaining transparency about state-mandated fees not only helps avoid delays and transaction errors but also supports a smoother, more professional customer experience. As these changes take effect, proactive preparation will be the key to keeping operations running efficiently and preserving customer confidence in your dealership.