Contribution and Out-of-Pocket Limits for Health Savings Accounts and High-Deductible Health Plans

On May 16, the IRS released the Revenue procedure 2023-23 to provide the inflation-adjusted limits for health savings accounts (HSAs) and high deductible health plans (HDHPs) for 2024. The HSA limits are released every April or May by the IRS.

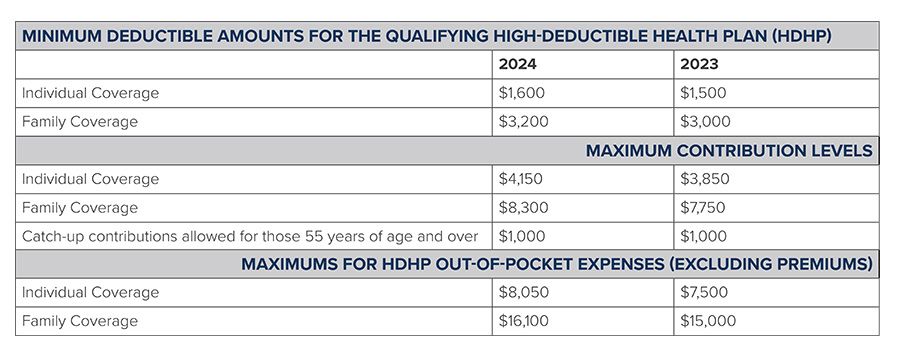

The 2024 annual limit on HSA contributions for self-only coverage will be $4,150. For family coverage, the HSA contribution limit jumps to $8,300.

Participants 55 and older can still contribute an extra $1,000 to their HSAs.

In 2024, a high-deductible health plan (HDHP) must have a deductible of at least $1,600 for self-only coverage or $3,200 for family coverage. Annual out-of-pocket expense maximums (deductibles, co-payments and other amounts, but not premiums) cannot exceed $8,050 for self-only coverage in 2024 or $16,100 for family coverage.

The IRS also announced it will raise the maximum amount that employers may contribute to an excepted-benefit health reimbursement arrangement (HRA) in 2024 to $2,100.

The increased HSA contribution limits for 2024 provide an opportunity for individuals and families to enhance their healthcare savings. Taking advantage of the triple tax benefits and carefully assessing healthcare needs can help make the most of these changes.

The adjusted contribution limits for HSAs take effect as of Jan. 1, 2024. The adjusted HDHP cost-sharing limits take effect for the plan year beginning on or after Jan. 1, 2024.

If you have any questions on HSAs or HDH plans, or any other insurance questions, please contact your NHADA Insurance Team at (603) 224-2369 or NHADInsurance@nhada.com.